Contractor Payroll |

Introduction

|

Paying an Independent Contractor is similar to paying an Assignment Employee, however, there are a few differences. |

- The Independent Contractor is not your employee so there are no payroll burdens however, the agency must pay the Worker’s Compensation Premium (Except in Alberta where Contractor’s must have their own WCB coverage)

- The Contractor is not deducted for Income Tax, CPP or EI

- The Independent Contractor must submit an Invoice to you to be paid for their time

- The invoice should include an amount for GST/HST and you will need to pay this in addition to paying for the Contractor’s time

- Ensure you save a copy of the Invoice along with the timesheet for payroll back up

-

The Independent Contractor will receive a Payment Receipt instead of a Pay stub since they are not an employee

Please note: The Get Pay Stub option in Stafftrak cannot be used for Contractors. If a Contractor loses their original payment receipt and requires another copy, please contact your Client Service Specialist for assistance. ROE’s and T4’s are not issued for Independent Contractor’s since they are not employees.

PAYROLL RUN

2

At the main screen of Stafftrak, select the Payroll toolbar button.

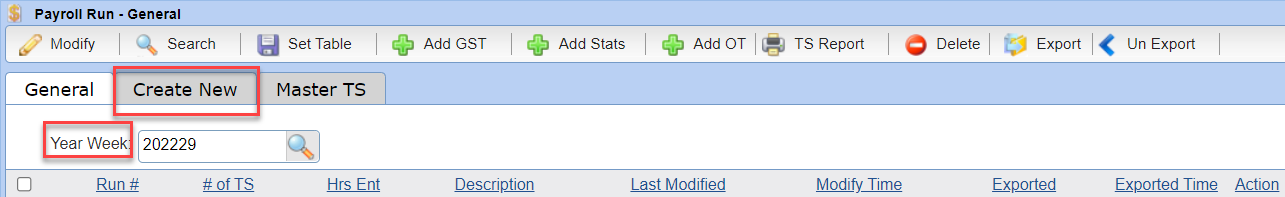

Select the Create New tab. Be sure the Year Week is showing appropriately.

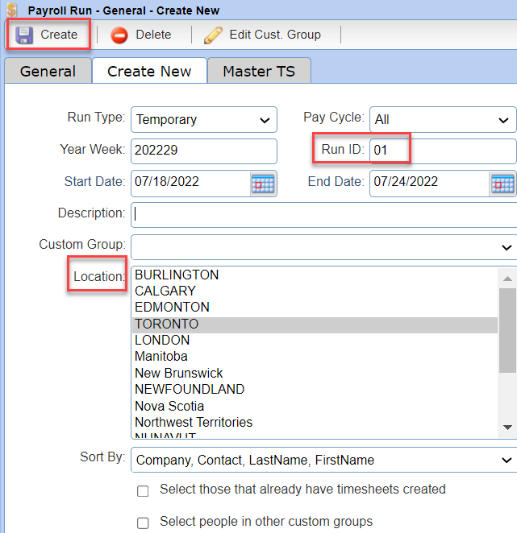

Review Payroll Run options, type in Run ID #, select Location, lastly, select the Create button.

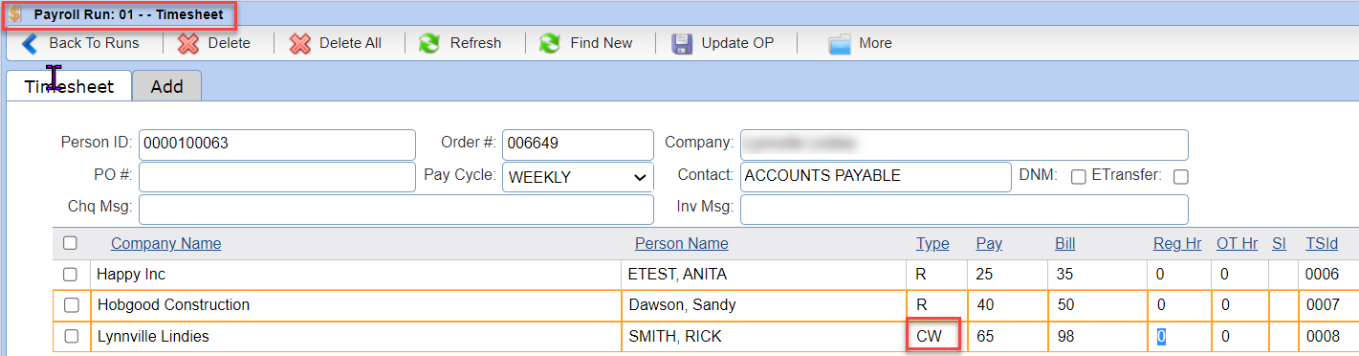

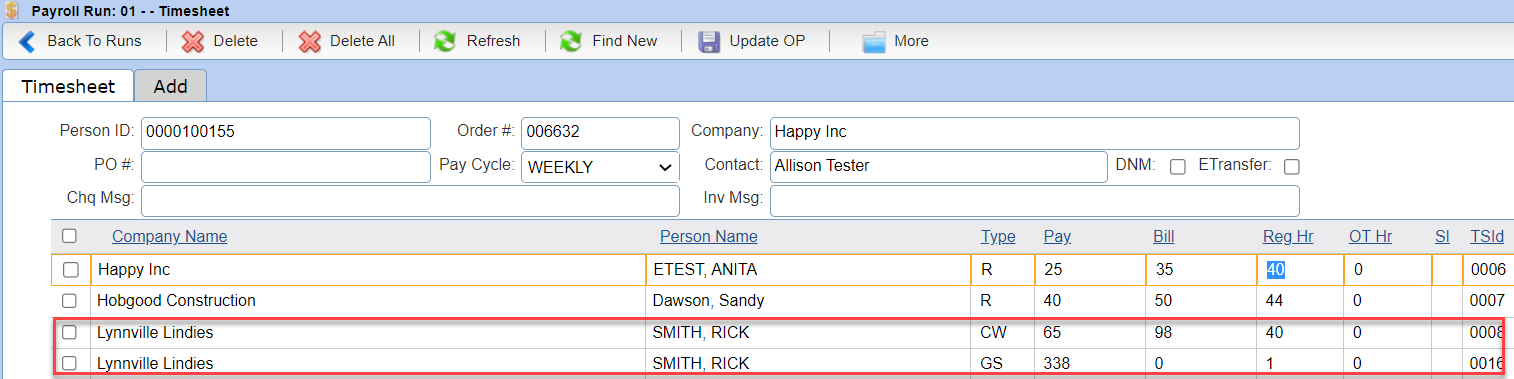

Open the run. Enter the hours of the Contractor in the timesheet. Note the Timesheet Type is = CW rather than R like it would typically be for an Assignment Employee.

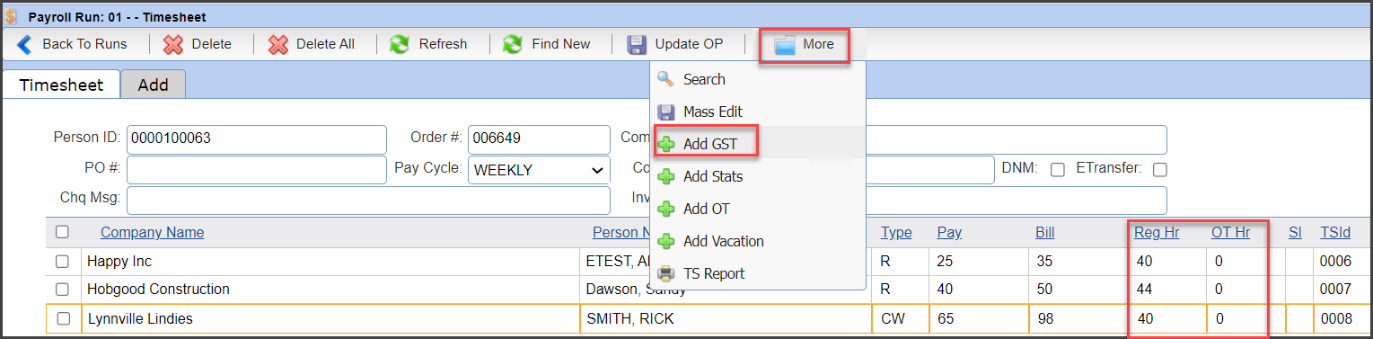

After entering all hours of your payroll run there is one final step needed to ensure Contractors are paid GST/HST. On the payroll timesheet toolbar, select the More button, then select Add GST.

Stafftrak responds with a pop-up message sharing GST has been added successfully.

You will now see an additional Timesheet line has been added with a GS Timesheet Type and the amount of GST/HST to be paid will be automatically calculated based on the province where the Contractor is working.

As always, finish up by checking your Timesheet Report thoroughly before exporting your payroll run.