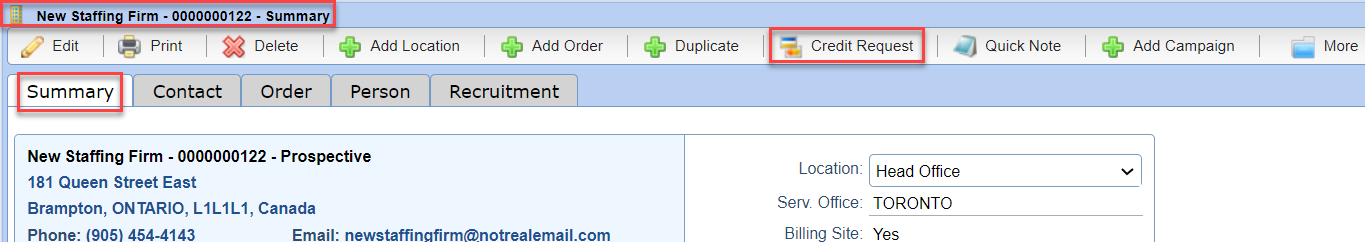

Company – Credit Requests |

Introduction

|

A newly entered Company defaults to the type “Prospective”. Until there has been a credit request check completed, the Company cannot be set to Active. If a Company is not Active a Person cannot be added as active to an Order. People2.0 suggests requesting credit as early in the sales process as possible. Before you may fill an order with a Company, you must ensure that a Credit Check has been done. After this is complete (and depending upon the results of the check), credit will be assigned in Stafftrak, the Company be set as Active, and Persons may be added to the order as active (to pay them). Why is a Credit Request required?

|

|

2 |

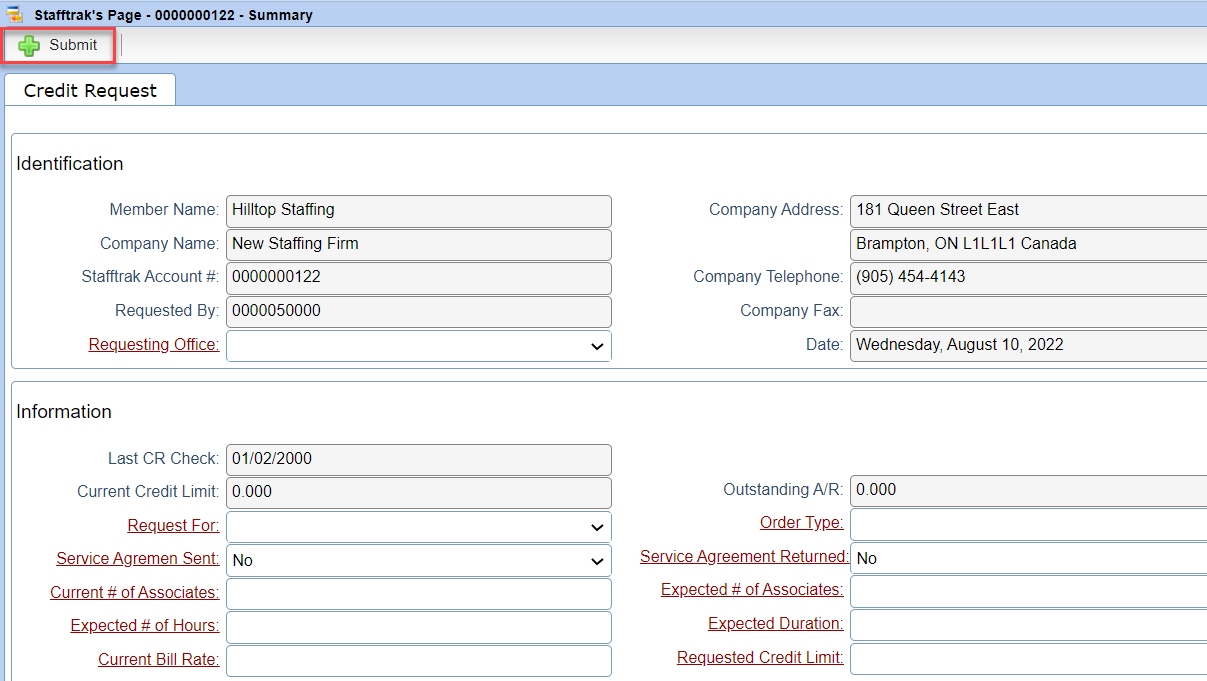

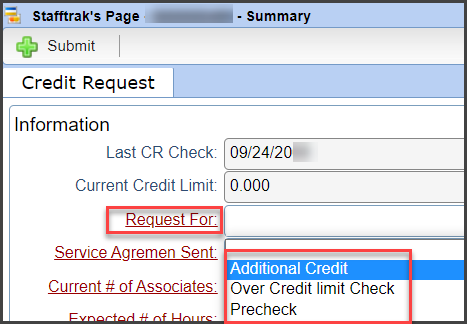

Within the Credit Request screen, enter in all red (required) fields. Select Submit when complete. Note: We recommend calculating approximately 1 month of invoicing since the default Invoice Due date is 30 days from the date of the invoice. |

|

|

|

|

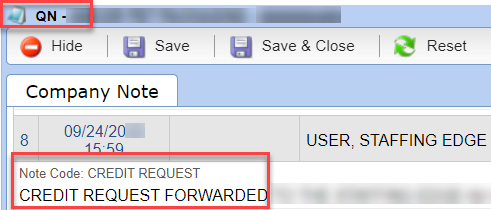

Once Submitted, the Company file will populate with a Note and a Task sharing the submission of the credit request directed to People2.0. |

|

|

|

|

|

4 |

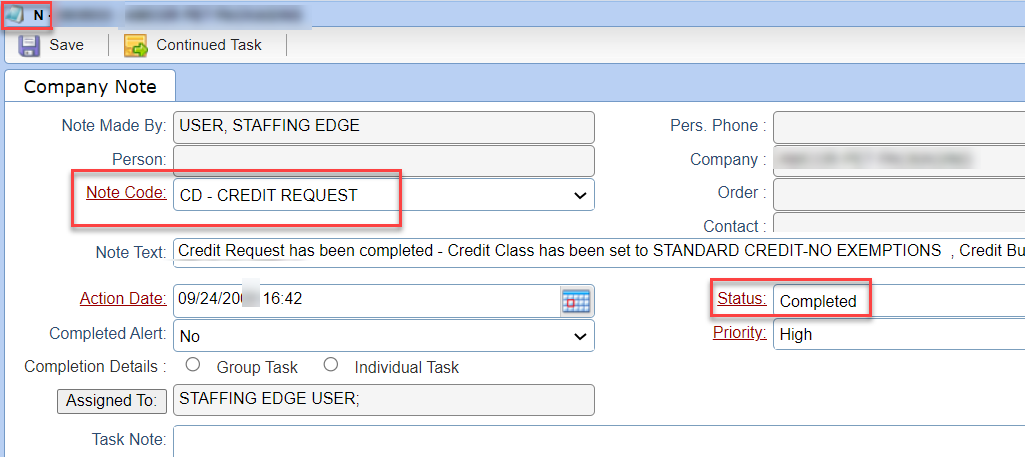

After the credit request has been completed, another task will populate in the Company file and within the users Task list. Note: If this was for a new Company, the Company will also be made Active. |

|

|

|

|

5 |

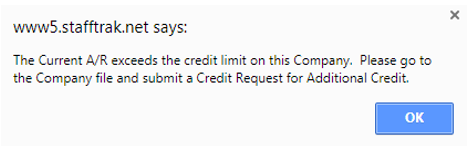

In some cases, within an Order, you may receive a message that says the current A/R exceeds the credit limit on a Company. This means the Company doesn’t have enough credit and you need to submit a request for Additional Credit. Within the Company file, select the Credit Request button, and from the Request For field, select Additional Credit. |

|

|

|

|

6 |

If the credit check is unsuccessful, contact your Collector to find out more information. There may be options that will allow you to do business with this client, such as Accounts Receivable Insurance and/or payment by credit card. If there is not enough information about the company, you may be asked to get Credit References for the Company |