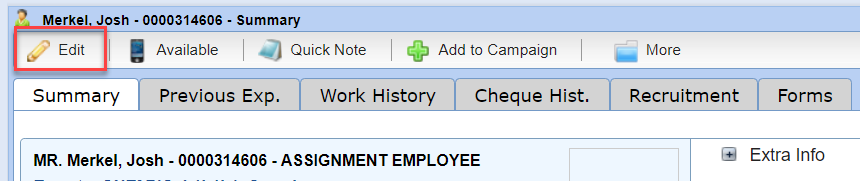

Adding Payroll Information |

Introduction

|

This QRG shares details related to entering critical payroll information in Person files. Payroll is a permission-based function. While anyone can view what the Person file contains, only those with the proper permissions may modify Payroll entries. Contact Client Services for more information clientservicescanada@people20.com. |

|

4 |

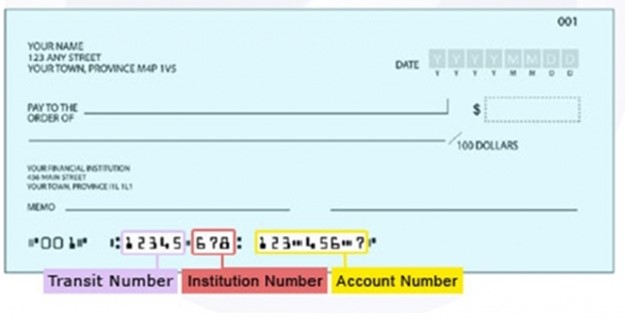

Note the sample cheque below.

|

|

|

|

|

5 |

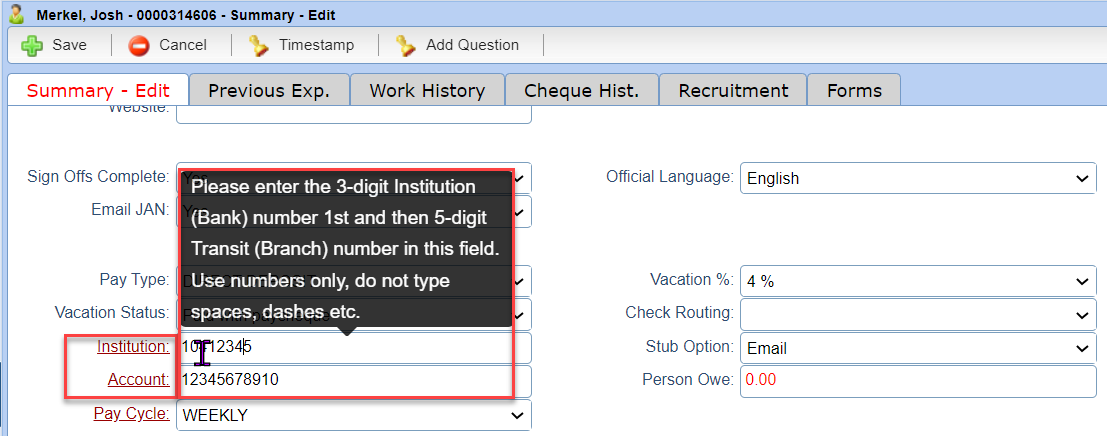

Always check the numbers entered are correct. Whenever possible, have another person double-check the numbers are 100% accurate. Incorrect numbers (even 1 digit wrong) will result in the Person not getting paid correctly and in some cases could result in the deposit of funds into the wrong account. If this happens, the money may not be retrievable, causing double payment of the funds. |

|

6 |

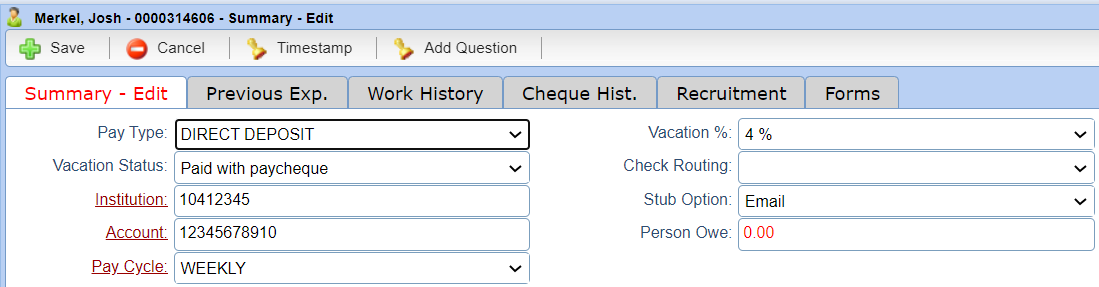

Vacation Status: This determines if the Person will receive vacation pay on each cheque or if it will be accumulated to be paid at a later date. Please reference the workers signed employment agreement to select the correct option. |

|

7 |

Stub Option: This determines how the person will receive their pay stub. We encourage the use of email for all paystubs. If the person has an email address on file but does not wish to receive their pay stub by email you must select “refused email” in the drop down. If this is selected the pay stub will be sent by mail. |

|

Important Information to Note:

|

|

|

8 |

Cheque Routing: This can be used to provide instruction on how Cheques should be divided. For Members who have multiple branches this can be used determine which branch that a cheque can be picked up in. This is also used to determine which Office cheques will print in for members who have a Cheque Printer. This field is customized by member so please contact Member Relations if you need information on what your default settings are for Cheque Routing. |

|

9 |

Pay Cycle: This field will determine how a worker is taxed. If a person works and is paid on a weekly basis, this should be set to weekly. If a worker is paid on a bi-weekly basis, this should be set to bi-weekly. |