Credit Requests

Before you fill an order with a company you must ensure that a Credit Check has been done and credit has been assigned in Stafftrak or you will be unable to add a person to the order as active to pay them.

The Staffing Edge suggests requesting credit as early in your sales process as possible.

Why should you do a Credit Check?

- The Credit Check provides early acknowledgement that the client is viable and worth pursuing

- Gives you the opportunity to negotiate terms early in the process if required (very valuable for high volume accounts)

- It eliminates the embarrassment of negotiating rates to then find out the client has a bad credit history, and that developing a business relationship is no longer possible

- It ensures that The Staffing Edge has reviewed the client credit history and that you can continue to focus on customer service and closing the sale

When to do a Credit Request

- As early as possible in the Sales Process

- Must be done before you will be able to do any payroll in Stafftrak

- Must be done when a company has been Inactive for more than 30 days

- Additional Credit must be requested when the company’s Outstanding Accounts Receivable exceeds their Credit limit in order to put new people on the order in Stafftrak

Submitting the Request

You can request a pre-check or additional credit directly from the company screen in stafftrak.net.

Before submitting the request, please ensure that the company file in Stafftrak is complete with full Company name, full company address and phone number. Without complete information this will make the Credit Check process difficult to complete.

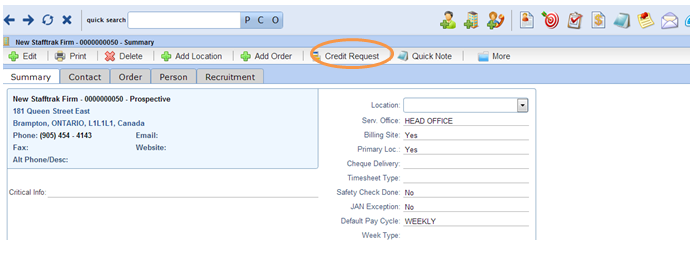

- From the company summary page, click on the Credit Request button at the top of the screen

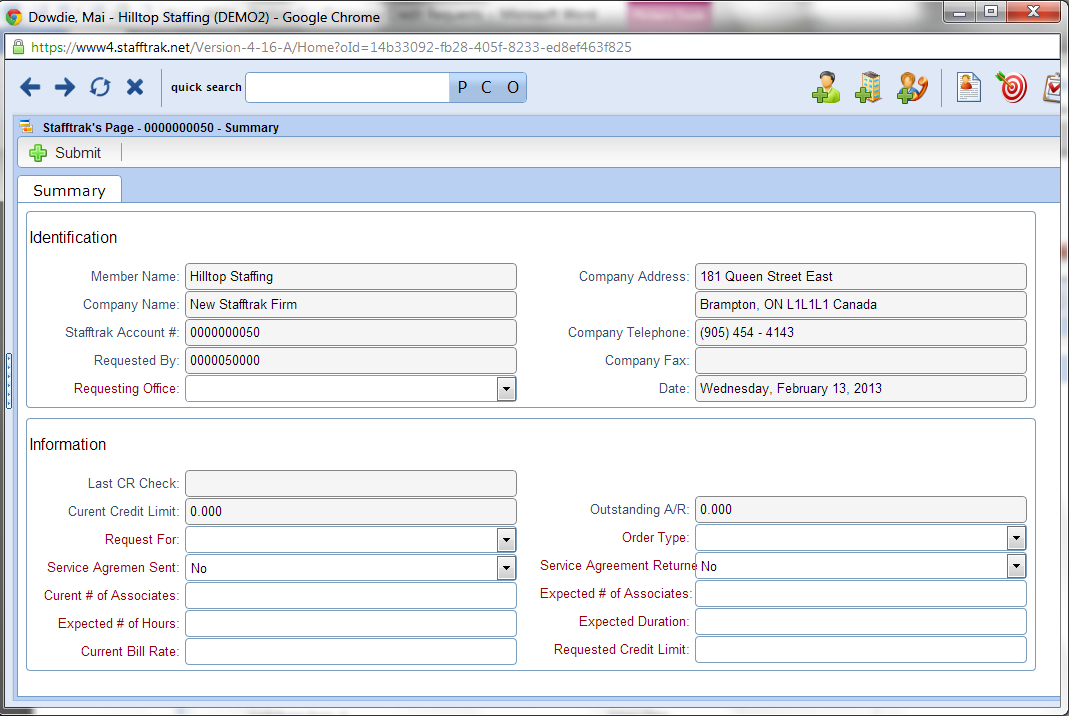

- A window will appear listing a number of mandatory fields which need to be filled out before submitting to the TSE credit dept.

- Fill in all information to the best of your ability.

- The Credit department will need an estimate of expected billing for this client

- We recommend calculating approximately 1 month of invoicing since the default Invoice Due date is 30 days from the date of the invoice

- Once completely filled in, click the Submit button – it is then directed to the TSE credit department

- An automatic note and task generated will appear in the company quick note screen showing that a credit request has been sent to TSE

- Once completed, another task will be generated and will appear on the company file and in your Task list

Managing Company Credit

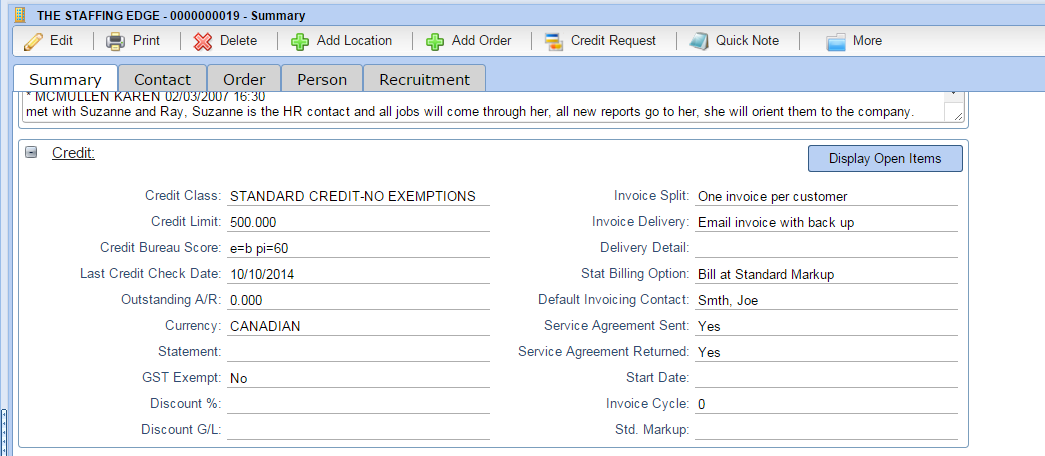

The Credit and Collections Department will fill in the fields on the Company file under the Credit area. You can use this area for reference. If a Credit Check is Successful:

- Credit Class – Standard Credit/No Exemptions

- Credit Limit – Will show an amount

- Company will be made Active

If you have questions about the Credit Check you submitted, please contact your Collector.

If the credit check is unsuccessful

- Contact your Collector to find out more information

- There may be options that will allow you to do business with this client, such as Accounts Receivable Insurance and/or payment by credit card

- When there is not enough information about the company, you may be asked to get Credit References for the Company