Credit/Debit Process

Although you should make every effort to ensure there are no errors before exporting payroll we understand that there are times when an Invoice error happens. For example: When a customer has approved incorrect hours on a timesheet or there has been a miscommunication surrounding Bill Rates. Any time that there is an error on an invoice you will need to determine whether you need to do a Credit or Debit to resolve the issue.

When to do a Credit

When you have over-billed your client, you should issue a Credit for the amount you have overbilled. In some cases if there are several errors on an invoice your customer may request that the invoice be corrected or revised. We do not revise invoices manually as this is bad practice and not acceptable for Finance Audits. In this case you would have to credit out the entire invoice and then enter a Rebill in Stafftrak to Generate a new invoice with the correct information.

When to do a Debit Note

When you have under-billed your client you will need to do a Debit note to bill them for the remainder of money owing to you. If your client requests that you revise the current invoice, you must first credit out the entire invoice and then enter a Re-bill in Stafftrak to create a new Invoice.

When to Contact your Collector

- When you have an invoice error and need assistance or have questions about what to do

- When you are going to enter a credit or debit on your own you should let the collector know

- If you would like TSE to enter the Credit or Debit for you (Credit/Debit Advice form)

ENTERING YOUR OWN CREDIT

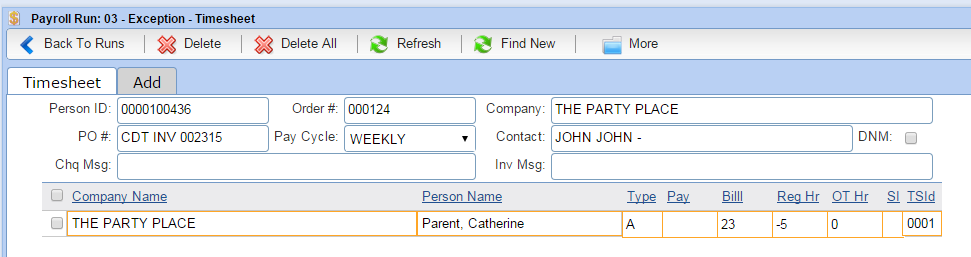

To Credit part of an invoice:

- Inform the Collector on the account that you are crediting part of the Invoice

- In the PO or Invoice Message on the Credit, enter the Invoice number of the original invoice where the Credit should be applied

- Remove the pay rate from the timesheet line if you only want to do a Credit but don’t want to take back from the employee

- Enter the number of hours you need to credit as a negative in the Reg Hours field Example: -5

- If you are crediting Overtime hours then enter it as a negative in the OT Hours field

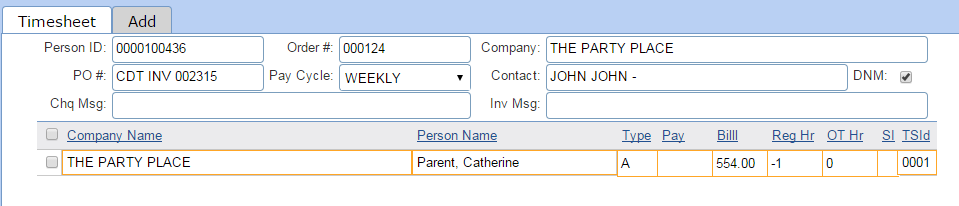

To Credit the entire invoice:

- Inform the Collector on the account that you are crediting the entire Invoice

- In the PO or Invoice Message on the Credit, enter the Invoice number of the original invoice where the Credit should be applied

- Remove the pay rate from the timesheet line (In this case it’s unlikely you are doing the pay adjustment at the same time as the credit)

- Enter the Sub Total amount of the Invoice in the Bill Rate field and -1 in the Reg Hours field

- Check the DNM Box (Do Not Mail) so a copy will not be sent to your customer

ENTERING A DEBIT

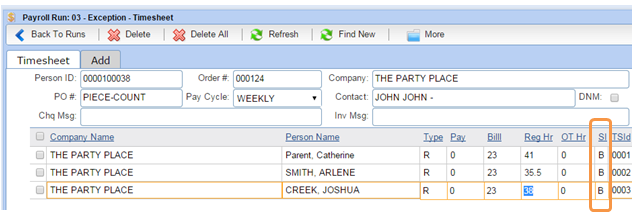

When you determine that you have under billed and need to do a Rebill to create a new invoice. A Debit is also done when you have had to Credit out an entire invoice to create a new invoice with the correct information.

To Create a Debit:

- Remove the pay rate from the timesheet line to ensure you don’t pay the employees again

- Add a letter to the SI (Separate Invoice Column) to ensure this Debit is created as a completely separate invoice from the current weeks invoice

- Enter all hours the way they should have been entered to create the new Invoice (Debit)

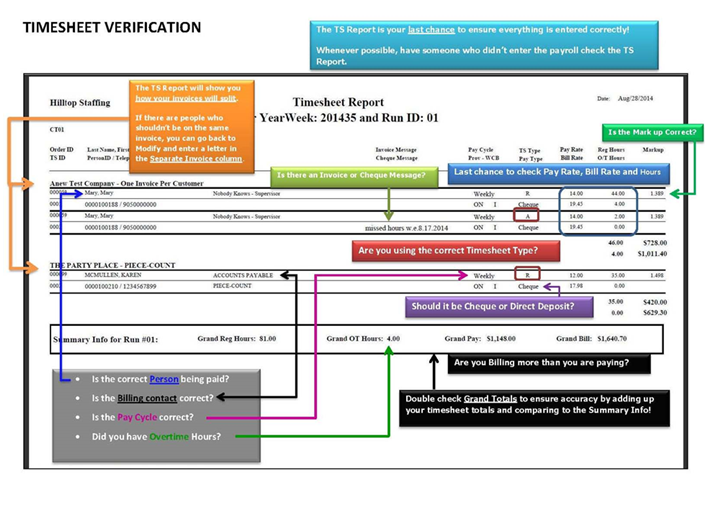

In all cases, thoroughly check the Timesheet report and whenever possible get someone else to Double Check the Report before you export the payroll. Making a mistake when trying to clean up errors will make it even more difficult to correct

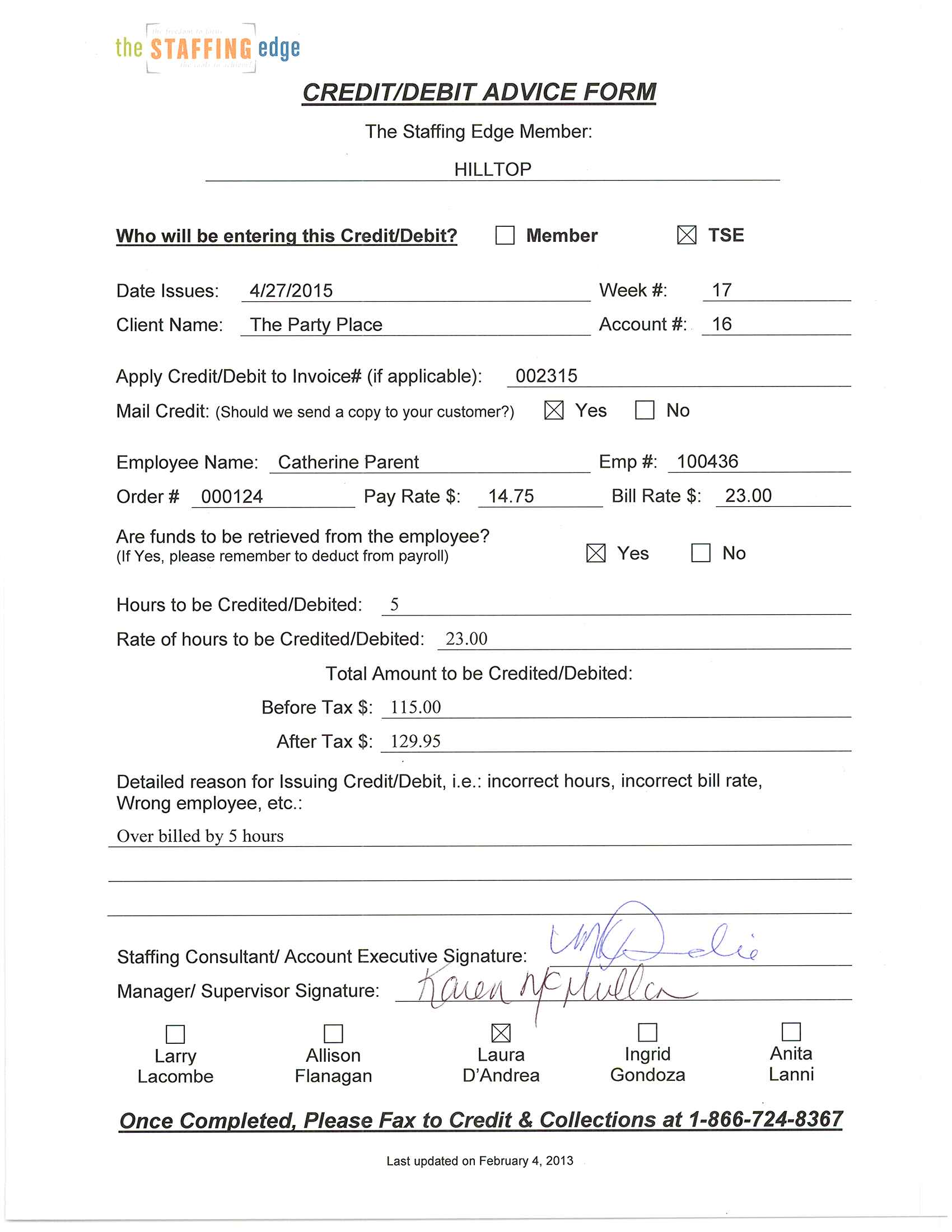

COMPLETING A CREDIT/DEBIT ADVICE FORM

If you prefer you can send in a Credit/Debit advice form to The Staffing Edge and we will enter the Credit or Debit on your behalf. It is important that you fill out all fields on the Credit/Debit form completely and have it signed by a manager. Once completed, please send a copy of the Credit/Debit Advice form along with a copy of the original invoice to your Collector at The Staffing Edge.

SAMPLE CREDIT/DEBIT ADVICE FORM

PREVENTION IS KEY!

Whenever possible it’s best that we don’t have to do Credits or Debits. We understand that there are times that the error is on the part of the worker or the client and you are informed after payroll is already processed. However, there are still many instances where the errors could have been prevented before payroll was exported.

CHECK THE TIMESHEET REPORT

Remember to verify your Timesheet report. This is your last chance to ensure that everything in the pay and bill is correct. You can see so many things on the TS Report that can help to prevent major pay and bill errors.